(LEX 18) — Natural disasters are becoming more frequent and expensive. This is creating a problem in the insurance market as companies raise rates or drop coverage in high-risk areas entirely, according to reports from around the country.

Kentucky experiences significant flooding and damaging tornadoes, making it particularly vulnerable to these market changes. So, on Wednesday, Kentucky's Disaster Prevention and Mitigation Task Force met with insurance experts to find solutions to maintain affordable coverage in the Commonwealth.

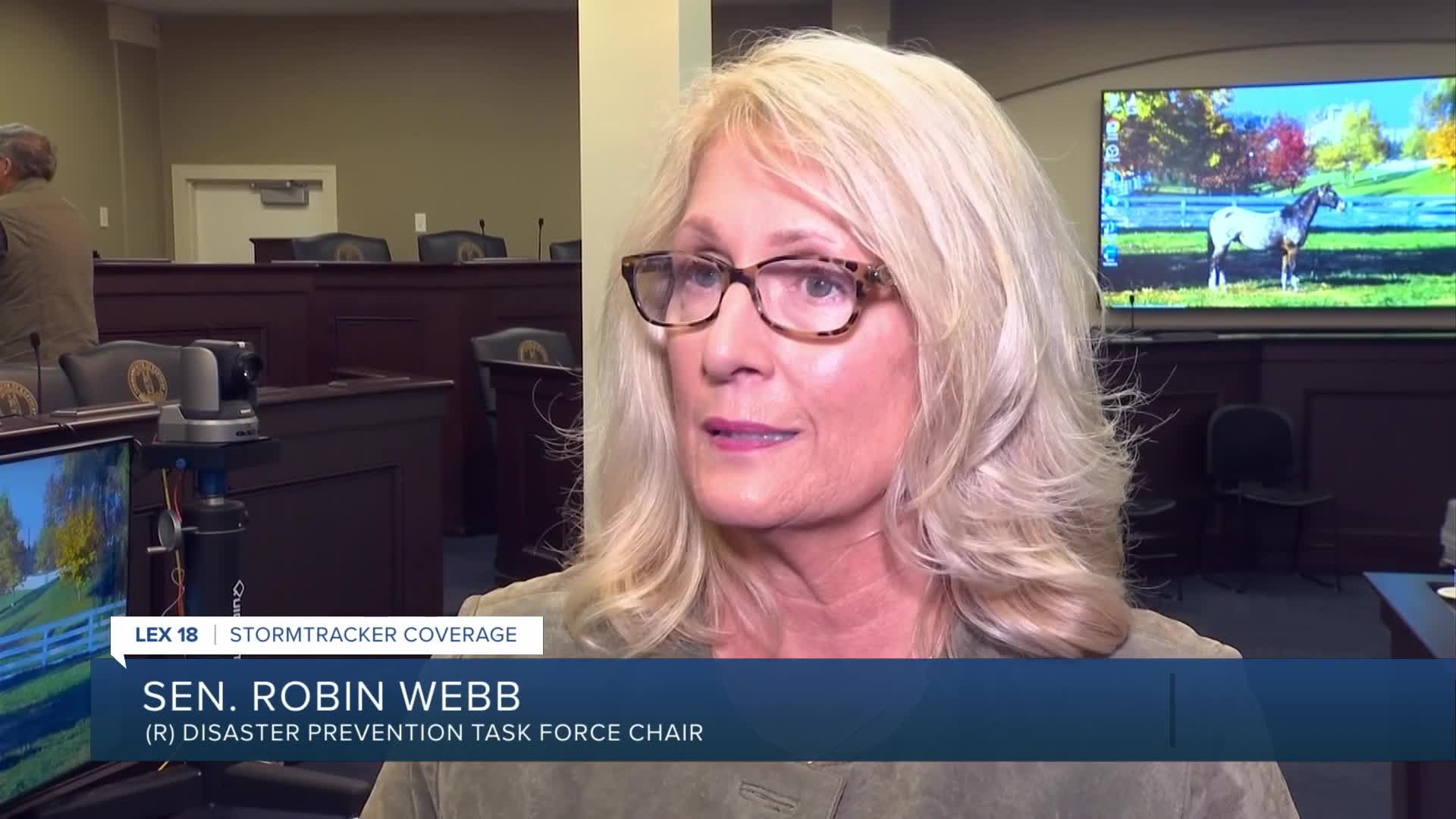

"Markets are being exited, accessibility is sometimes limited and affordability for various reasons - constructions costs and other things are just skyrocketing. And we fear that those markets will be out of touch for the average person," said Sen. Robin Webb, the chair of the Task Force.

Insurance experts and lawmakers agree that the state needs to invest more in mitigation efforts. For every dollar spent on making Kentucky more resilient to flooding, the state receives anywhere from four to 12 dollars in disaster repair savings, according to Webb.

"Mitigation and prevention is a big part of resilience," Webb said. "And whether that's safety codes, building in the wrong place or the right place, in urban areas - storm water and the handling of runoff is crucial from a hydrological standpoint."

"So, we're going to look at all the technical things, all the programs that are out there, how to build better, how to build smarter to save lives primarily and to save money and to allow citizens to maintain insurance," she added.